salt tax cap removal

52 rows The SALT deduction allows you to deduct your payments for property tax payments and either income or sales tax payments The maximum SALT deduction is 10000 but there was no cap before 2018 You must itemize using Schedule A to claim the SALT deduction. The deduction would be zero for filers making 1 million or.

Don T Miss The Election For The Salt Cap Workaround

California Approves Workaround to SALT Deduction Cap.

. The deal which was included in President Bidens. By Joey Fox October 20 2021 252 pm Responding to reports from yesterday that the State and Local Tax SALT deduction cap lift may be removed from President Joe Bidens Build Back Better plan Gov. Doubling the cap to 20000 would remove the marriage penalty but it would reduce federal revenue by about 75 billion between 2022 and 2025.

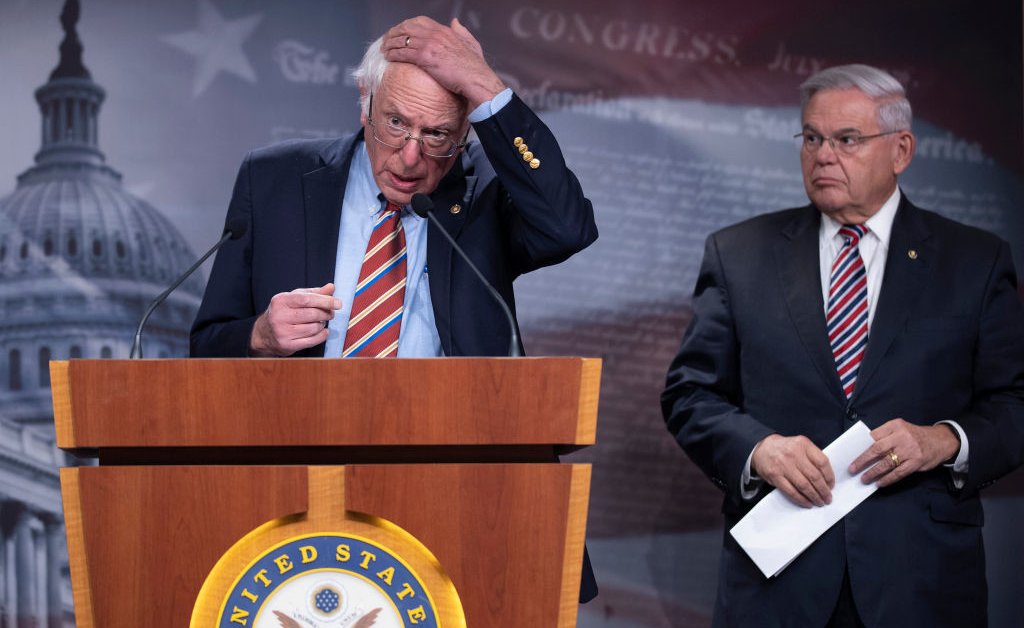

A spokesman for House Speaker Nancy Pelosi says a SALT. The Democrats many from New York and New Jersey are angry that former President Donald Trumps tax law capped SALT deductions at 10000. Another proposal would increase the SALT cap to 15000 for single filers and 30000 for joint filers.

California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized deduction limit imposed by the 2017 tax reform that adopted elective pass-through entity PTE tax legislation. Discover Helpful Information And Resources On Taxes From AARP. Most people do not qualify to itemize.

The state Franchise Tax Board reported that in 2018 the SALT cap cost Californians 12 billion. 800 900 est The Junk Luggers offer local junk removal services in Los Angeles but also to many other states across the nation. The bill would raise the cap to 60000 for filers making 400000 to 500000 then reduce it by 10000 for each 100000 of income.

But a downstream impact would be to remove a bit of the deterrent to higher. The 10000 cap imposed in 2017 as part of the Trump tax cuts will sunset in 2025. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround.

Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro area particularly hard. On their website they offer a price estimator. Enacted by the Tax.

Phil Murphy today reaffirmed his strong support for lifting the cap but didnt sound willing to scrap the reconciliation bill over the issue. The California Franchise Tax Board reported that in the 2018 tax year the SALT cap cost Californians 12 billion. The fight to remove the cap for state and local taxes SALT continues for three North Jersey members of the House.

Junk King prices are based off of the truck loads. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. The Washington-based Institute on Taxation and Economic Policy has estimated that in 2022 the SALT.

On July 16 th the Governor signed AB 150 a budget trailer bill. This would reduce federal revenue by about 135 billion between 2022 and 2025. During negotiations in the Senate on the 737 billion spending bill Republicans like South Dakota Sen.

The latest SALT deduction bill introduced by Representatives Tom Malinowski of New Jersey and Katie Porter of California would remove the current 10000 cap entirely for those making less than. For the Estimates we ran in Los Angeles we saw prices range anywhere from 758 to 798. Josh Gottheimer Tom Malinowski and Mikie Sherrill were joined by Katie Porter D-CA and Tom Suozzi D-NY in urging the House Appropriations Committee to provide tax relief in the Fiscal Year 2023 Financial Services and General.

Dems Don T Repeal The Salt Cap Do This Instead Itep

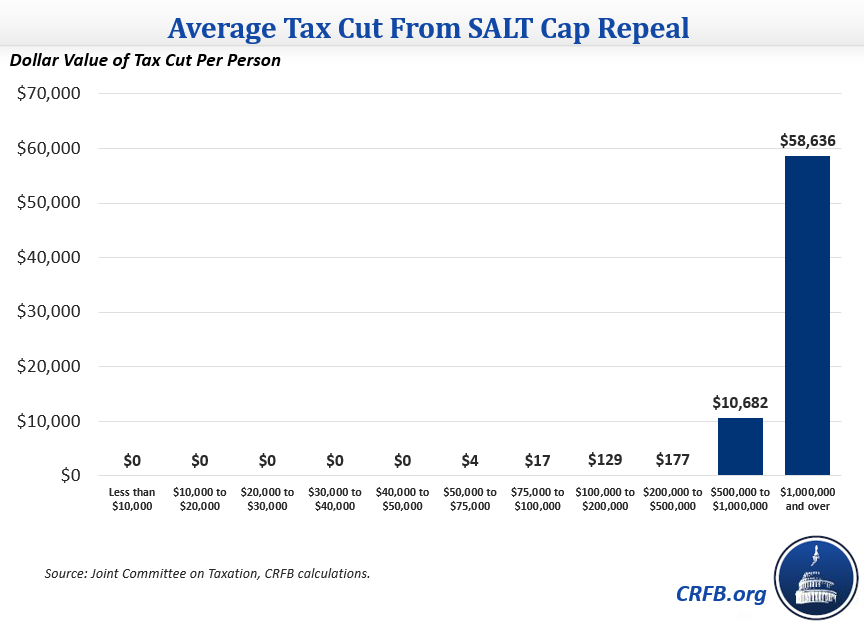

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

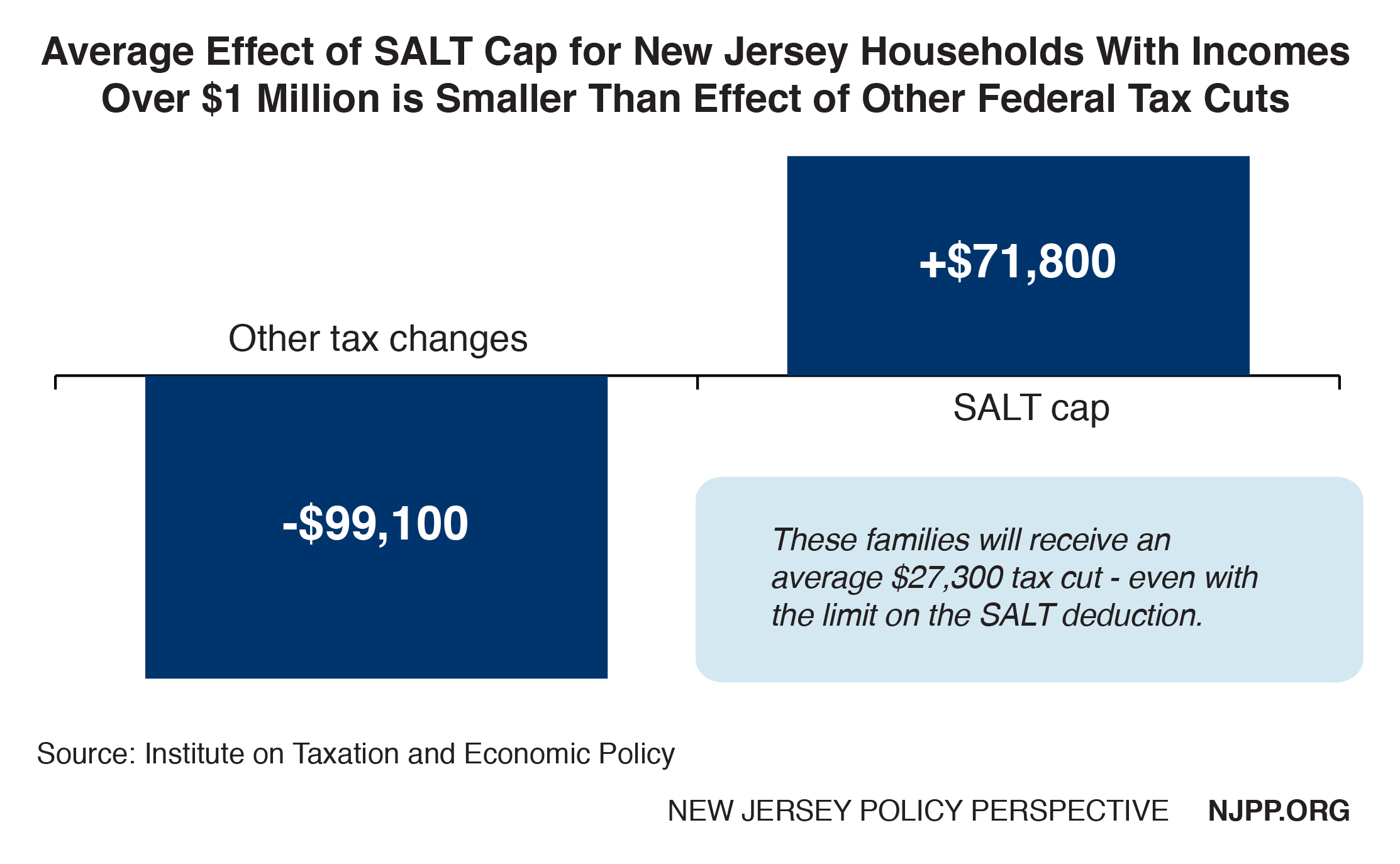

A Grain Of Salt New Jersey Needs More Than Workarounds To Respond To Gop Tax Plan New Jersey Policy Perspective

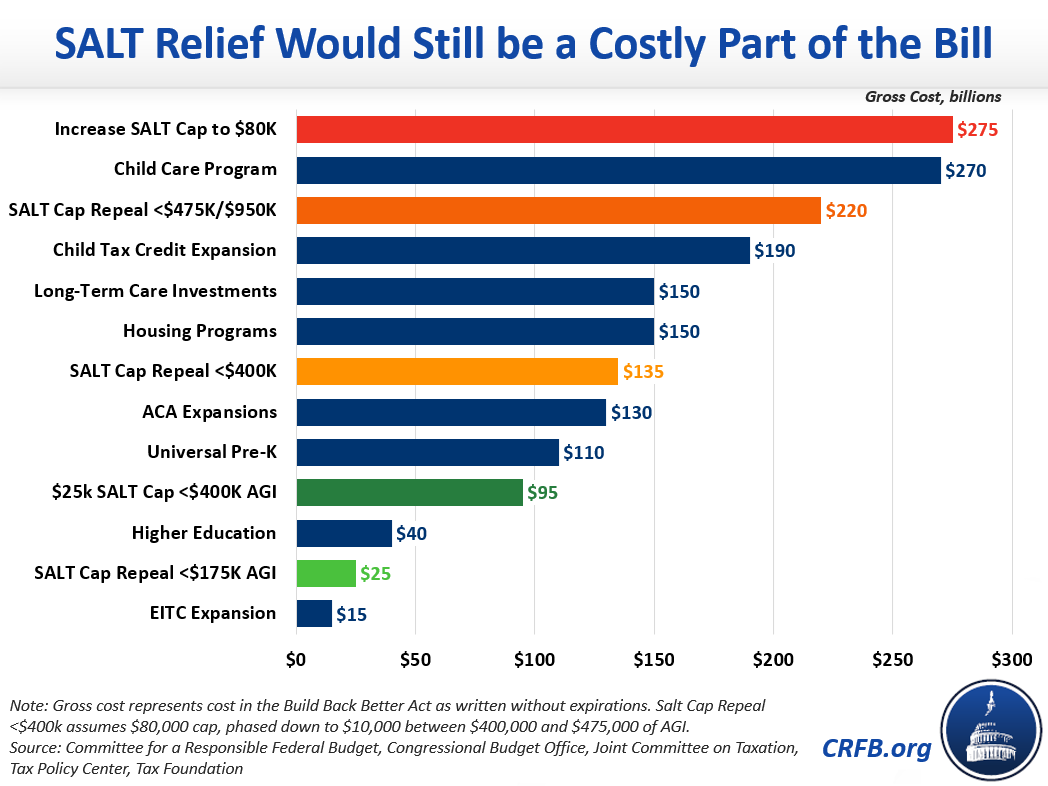

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

:max_bytes(150000):strip_icc()/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Why This Tax Provision Puts Democrats In A Tough Place Time

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget